双击此处添加文字

SERVICE PHONE

15136233309

业务领域 Business area

始终坚持为业主提供优质服务的目标,遵循公开、公平、公正的原则,恪守诚信、规范、科学、严谨的宗旨,严格执行相关法律法规的规定,切实维护业主单位的合法权益。

关于我们 About us

开信集团成立于2007年9月,注册资金为1亿元人民币,公司总部位于河南省郑州市西三环大学科技园,自有办公面积1000余平方面积,现有职工200余人,具有中级职称以上人员50多人。现有注册咨询师、注册造价师、注册监理师、注册建造师、招标师、信用管理师、房地产估价师、土地估价师、资产评估师等各类专业技术管理人才…

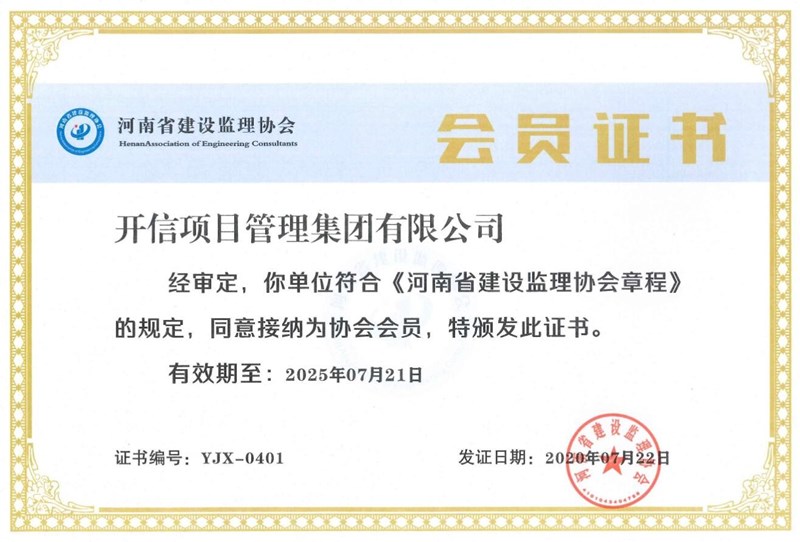

行业会员 Members

联系我们

QQ :1302652112

电话:0371-86568900

邮箱:hnkxgl@126.com

走进开信

业务范围

公司简介

公司文化

组织架构

分支机构

社会公益

工程咨询

勘察设计

工程造价

工程监理

招标代理

工程担保

第三方验收

施工总承包

评估服务

拍卖服务

消防技术服务

环境影响评价

- 建设工程质量检测(建盛检测) 2023-07-28

- 建设工程质量检测资质 2023-07-28

- 卫生检验检测(创达检测) 2023-07-28

- 卫生检验检测资质 2023-07-28

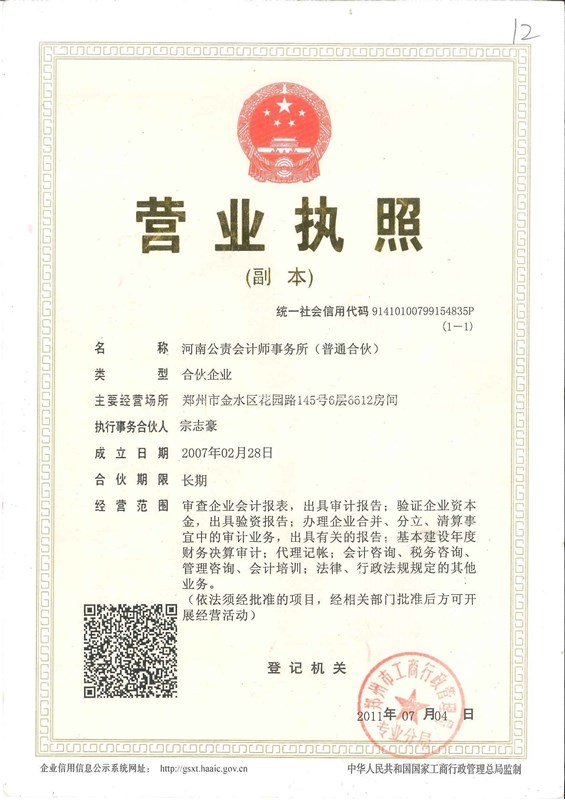

- 会计师事务所(公责) 2023-07-28

- 开信集团社会公益案例6 2022-10-17

- 开信集团社会公益案例5 2022-10-17

- 开信集团社会公益案例4 2022-10-17

- 开信集团社会公益 2022-10-17

- 开信集团社会公益 2022-10-17

- 完善招标投标交易担保制度 进一步降低招标投标交易成本 2023-02-16

- 喜讯!!!开信集团在社会消防技术服务信息系统备案成功! 2023-02-07

- 喜报!!!河南正昊房地产评估有限公司人民法院诉讼网备案通过! 2023-01-17

- 喜讯!!!今日,开信集团在人民法院诉讼网造价业务备案成功! 2023-01-17

- 开信集团顺利通过ISO三体系认证的年检 2022-12-12

- 关于规范招标投标领域信用评价应用的通知 2023-11-09

- 河南省住房和城乡建设厅关于印发《河南省建设工程工程量清单招标评标办法》的通知 2023-08-14

- 关于公开征求《河南省建筑工程工程量清单 招标评标办法(征求意见稿)》意见的通知 2023-04-10

- 国家发展改革委印发投资项目可行性研究报告编写大纲及说明 2023-04-10

- 关于河南省电子招标投标公共服务平台系统上线运行的通知 2023-03-29

- 河南林业职业学院校园水平衡基础改造项目 成交公告 2023-11-08

- 嵩县陆浑镇人民政府提升改造项目-结果公告 2023-11-08

- 2023-2025年林州市城乡供热有限公司无人值守换热站维保服务项目 竞争性谈判公告 2023-11-08

- 中国童装名镇柏庄产城融合示范园安阳市北关区柏庄 镇商贸街(彰德路-东方红)高低压线路改造配电项目 中标公告 2023-11-06

- 高村镇2021年第二批农村建设用地整治项目(高村镇北王 村、杜渠村、里沟村、王眷村) 成交结果公示 2023-11-03

权所有 Copyright © 2017-2022 开云手机站登入 豫ICP备19001588号-1